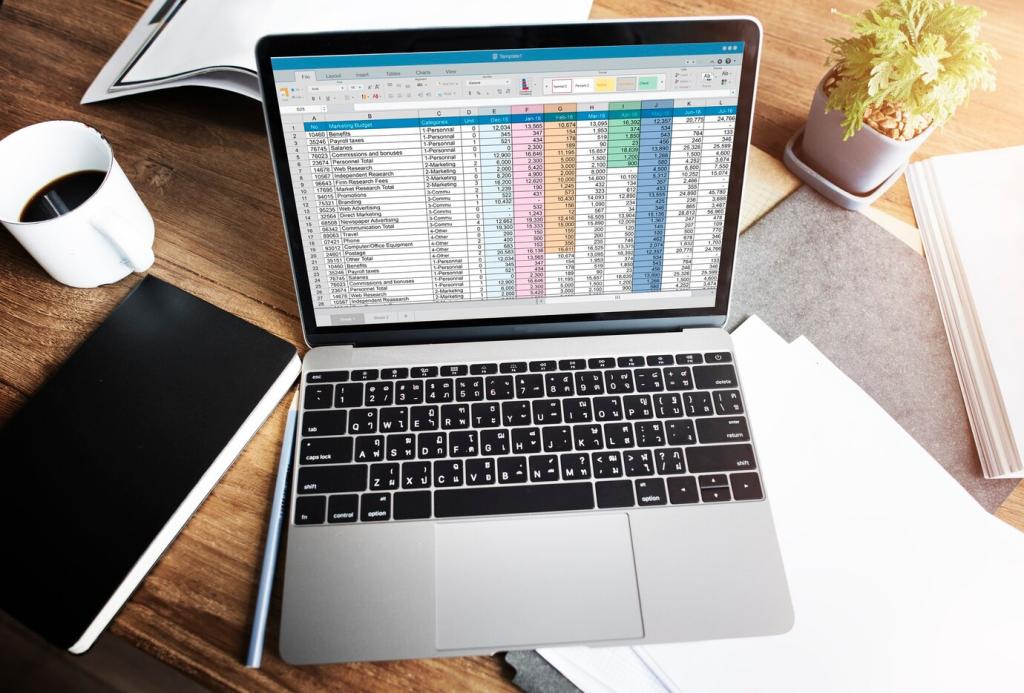

Cost-Benefit Math You Can Actually Feel

Free can be perfect—until it isn’t. If you spend hours searching for forms or wrestling with imports, you’re paying in time. Estimate your hourly value and compare it to an upgrade fee. Share your threshold: at what time cost do you pull the trigger on paid?

Cost-Benefit Math You Can Actually Feel

Paid plans often surface credits and deductions via guided questions and industry-specific prompts. For some filers, a single found deduction can offset the entire fee. Tell us a win: which credit or deduction did smarter guidance uncover for you last season?