Chosen theme: Understanding Features of Online Tax Tools. Explore how modern tax platforms simplify filings, protect your data, and help you claim every eligible deduction with confidence. Join the conversation, share your experiences, and subscribe for practical insights and timely updates.

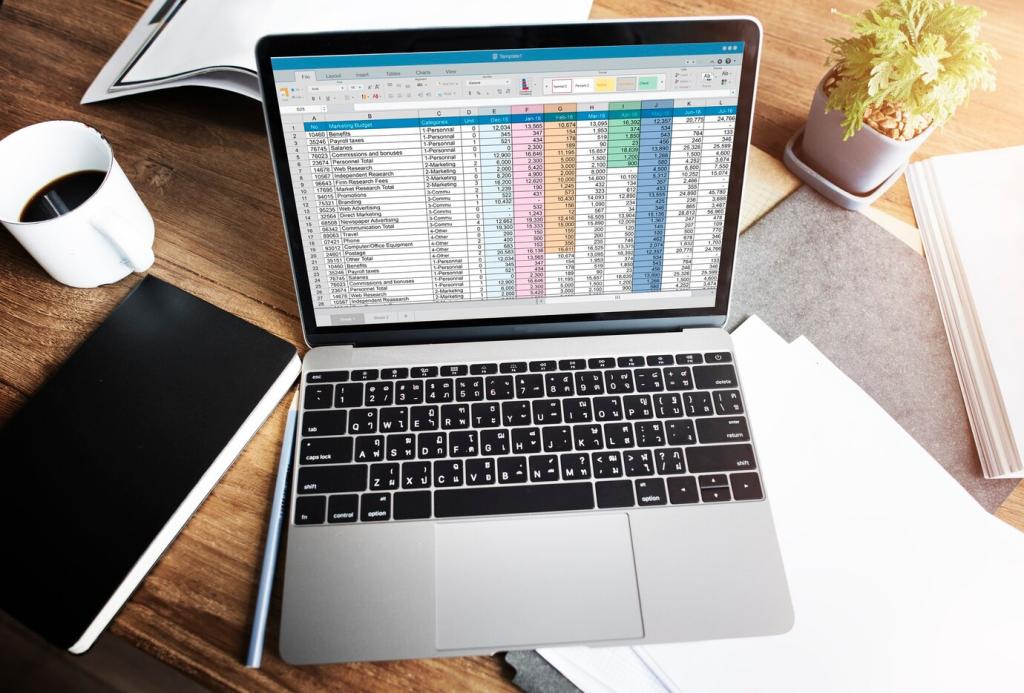

Automated Data Import

Skip manual entry by importing W‑2s, 1099s, and even bank interest forms through secure connections or PDF uploads. Smart parsers reduce typos, preserve formatting, and map figures directly to the right schedules, saving hours while improving accuracy for busy filers.

Smart Questionnaires

Adaptive interviews learn from your answers, hiding irrelevant sections and spotlighting opportunities you might miss. Whether you rent, run a side gig, or support dependents, guided questions translate complicated rules into everyday language that builds confidence.

Real-Time Error Checking

Validation engines flag mismatches, missing Social Security digits, or inconsistent totals the moment they appear. Instant guidance explains what went wrong and why it matters, helping you resolve issues before filing and preventing stressful IRS notices later.

Security and Privacy You Can Trust

Data is encrypted in transit and at rest using strong, industry‑standard protocols. This means your documents, identity information, and returns remain unreadable to prying eyes, whether you are uploading forms or reviewing last year’s filing on your phone.

Contextual Tips Right When You Need Them

Inline explanations translate jargon into plain English and link directly to authoritative references. When a rule gets tricky, examples appear with numbers you can edit, so you see exactly how a deduction, credit, or threshold would apply to your situation.

Live Help Options and Expert Review

Chat, callbacks, or screen‑share sessions connect you with trained specialists when you hit a wall. Optional expert review double‑checks your return before submission, catching nuanced issues like basis adjustments or nexus concerns that automated checks might overlook.

Anecdote: First-Time Freelancer Confidence

When Maya started freelancing, she feared quarterly taxes and forms she had never seen. The tool’s gentle prompts helped categorize expenses, while a five‑minute chat clarified estimated payments. She filed on time, avoided penalties, and felt genuinely in control.

Deduction Discovery Engines

Algorithms surface deductions and credits by comparing your profile with common scenarios, like student interest, energy upgrades, or educator expenses. You can accept, edit, or dismiss suggestions, with plain‑language explanations and links to documentation requirements.

Life Events Made Simple

Whether you moved, had a child, married, or changed jobs, guided flows adjust forms and thresholds automatically. You get tailored prompts for documents to gather, deadlines to watch, and potential eligibility changes that can materially impact your refund or balance due.

Side Hustles and Small Business Support

Expense categorization, mileage tracking, and gentle nudges for quarterly estimates keep business records organized. The tool remembers recurring vendors, suggests reasonable categories, and generates schedules that align with IRS guidance without forcing you into complex bookkeeping platforms.

Filing, Payments, and Deadlines

Step‑by‑step validators ensure your return passes schema checks before transmission. You receive clear status updates—from accepted to refunded—without refreshing portals, plus guidance for handling rejections, amended filings, or state returns that require additional documentation.

Filing, Payments, and Deadlines

Secure connections allow direct debit for balances due and routing to your preferred bank for refunds. Dashboards track payment confirmations, estimated arrival windows, and any follow‑up actions, reducing anxiety while eliminating awkward calls to multiple agencies.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.