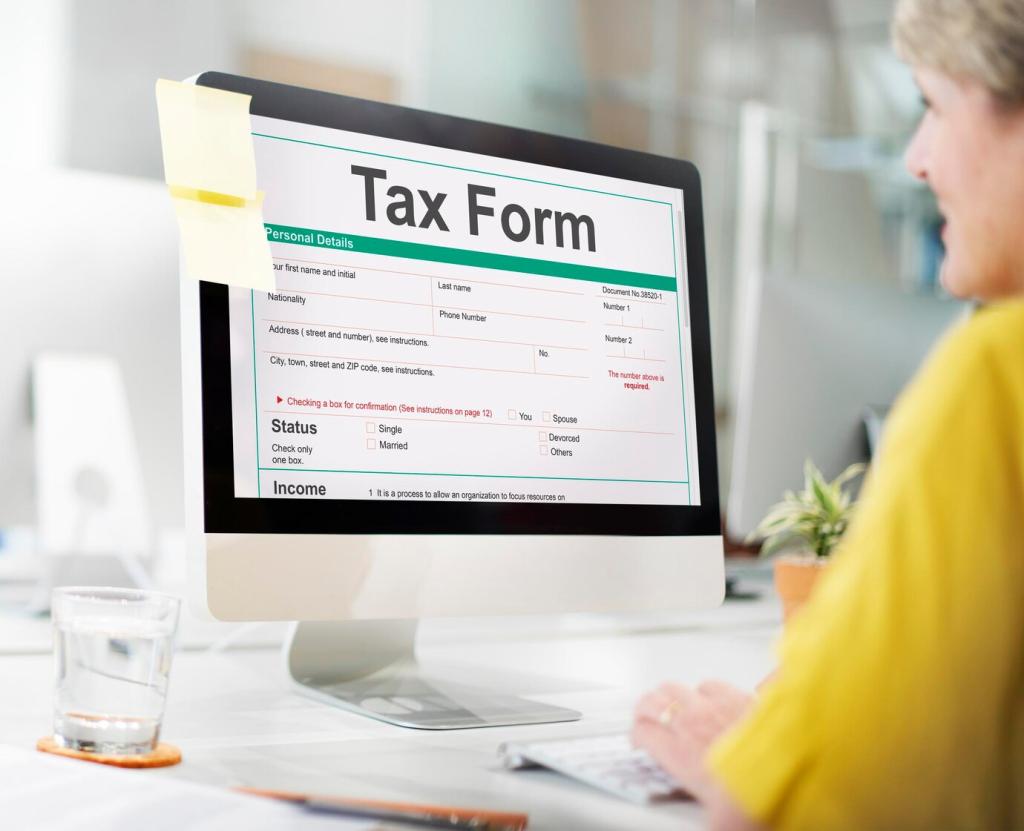

Map Your Tax Profile Before You Shop

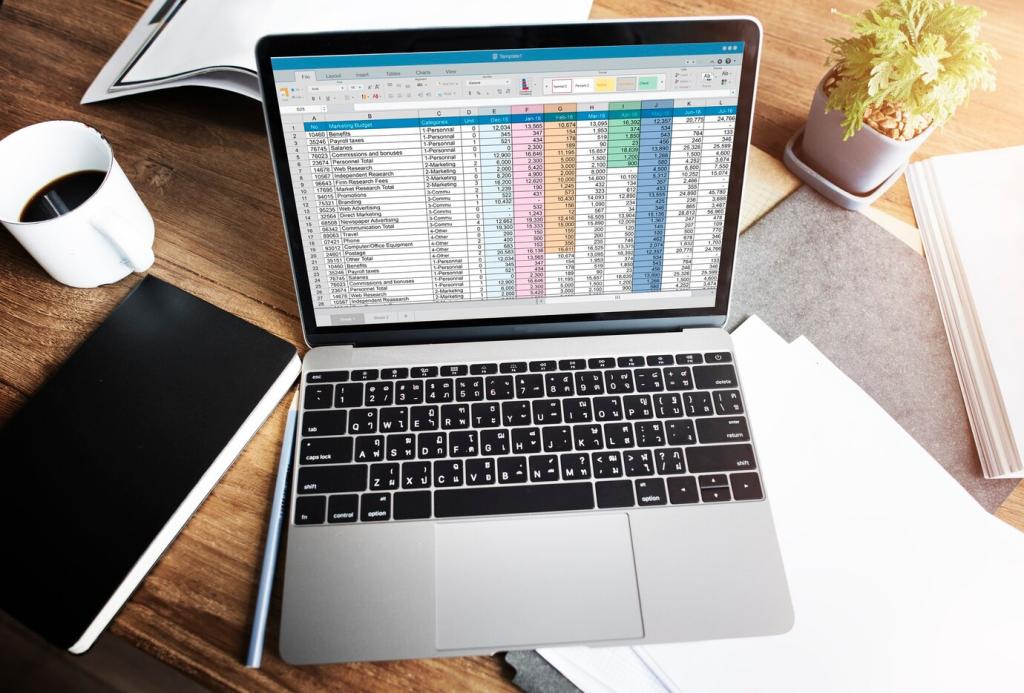

Write down what you actually file: W‑2, 1099‑NEC, 1099‑DIV, Schedule C for side gigs, Schedule E for rentals, HSA, student interest, or multi‑state. Share your list below, and we’ll help map features.

Map Your Tax Profile Before You Shop

Marriage, a new child, moving states, selling stock, starting a business—each can add schedules and complexity. Note them now so you pick software with the right interview paths and guidance.