Chosen theme: Benefits of Using Online Tax Preparation Services. Welcome to a smarter, calmer tax season where on-demand tools, clear guidance, and built-in safeguards help you file with confidence. Join our community, share your experiences, and subscribe for practical insights that make filing simpler every year.

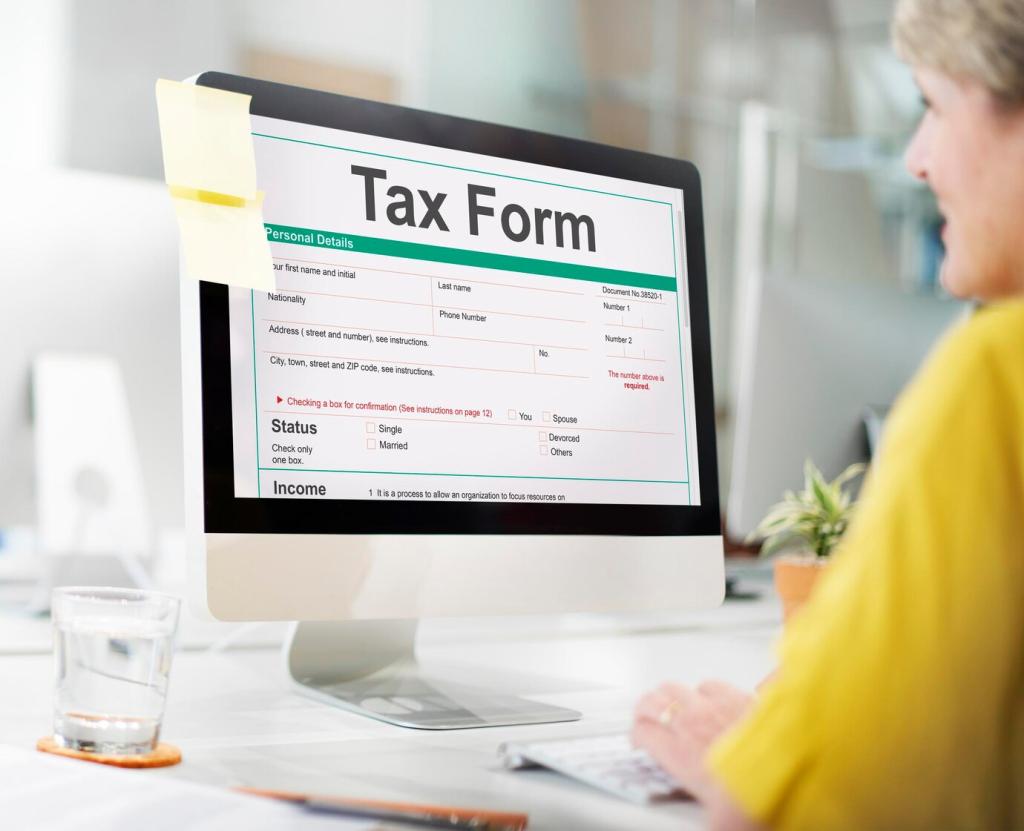

Convenience Without Compromise

Whether you work nights, juggle classes, or parent during unpredictable hours, online filing lets you pause, save, and return anytime. No phone calls, no waiting rooms—just steady progress at your pace. Tell us when you prefer to file and why it works.

Pull W‑2s, 1099s, and bank interest data straight into your return to reduce manual entry and typos. With fewer fields to retype, you stay focused on decisions that matter. Comment if data import has saved you time or prevented mistakes this year.

Snap photos of forms, answer guided questions on a phone, and finalize from a laptop later. Progress syncs securely across devices, so you never lose momentum. Subscribe for weekly mobile tips that help you streamline tax tasks on the go.

As you enter figures, real-time checks flag mismatches and missing fields. The system explains what needs attention and why, offering corrective steps. Share a time a validation alert helped you fix something you might have otherwise missed.

Accuracy and Intelligent Checks

Online platforms update forms and calculations as regulations change, helping you stay aligned with current requirements. No manual chasing of updates. Subscribe to receive concise updates so you understand what changed and how it may affect your filing.

Accuracy and Intelligent Checks

Maximizing Deductions and Credits

Instead of guessing which deductions apply, you answer plain-language prompts about life events, education, home office, and charitable giving. The software suggests relevant credits. Comment which question unlocked a deduction you had not considered before.

Maximizing Deductions and Credits

Freelancers, rideshare drivers, educators, and gig workers see prompts tailored to their work. Mileage, supplies, and professional fees are easier to document. Subscribe for sector-specific checklists to keep your records organized long before tax season arrives.

Security and Privacy Peace of Mind

Modern encryption protects data in transit and at rest, while multi-factor authentication adds a secure second gate. Set reminders to rotate passwords and enable alerts. Tell us which security practices make you feel most confident during filing season.

Security and Privacy Peace of Mind

Privacy dashboards clarify what is stored, what can be downloaded, and how sharing works. You can revoke access or delete documents when needed. Subscribe to our privacy checklist to review your settings before you upload any new tax forms.

Save Money and Time

Eliminating travel and scheduling frees up hours for work, family, or rest. You can spread tasks across short sessions instead of carving out a long appointment. Share how many hours you reclaimed by filing from home this season.

Save Money and Time

Carry-forward data from last year, automatic math, and pre-populated fields compound into meaningful time savings. Progress bars keep you motivated. Subscribe for a time-blocking guide that breaks filing into small, manageable sessions you can actually finish.

Help When Questions Arise

Contextual guides, searchable articles, and chat support meet you where you are. Explanations reference the exact screen you are on. Comment which article clarified a confusing topic and we will feature reader favorites in future posts.

Keep Records Tidy All Year

Upload receipts monthly, tag categories, and archive statements so nothing scrambles in April. Future-you will thank present-you. Comment with your favorite organization habit and inspire others to build a low‑stress system now, not later.

Plan Ahead With What‑If Scenarios

Explore how life changes—new job, move, education, or side income—could influence taxes before decisions are final. Scenario planning supports smarter choices. Subscribe for quarterly prompts that help you review withholding and estimated payments proactively.

Integrate With Your Money Life

Export summaries for budgeting tools, share safely with a financial planner, and track goals beyond filing day. Treat your return as a roadmap, not a one‑time chore. Tell us how integration helped you stay on target throughout the year.